schools first credit card limit increase

How to Request a Big One and Get Approved No Matter What. Business Credit Card Limit Increase.

All That You Need To Get Started With Social Skills At The Elementary School Level Social Skills Social Skills Groups Speech Activities

While the SchoolsFirst Federal Credit Union Inspire Mastercard cash advance fee is 0 a 1375 - 179 V APR.

. Regardless of why you want to increase your credit limit you may be wondering when is the right time. As with all our credit cards youll enjoy our everyday low interest rates and because we charge no annual balance transfer or cash advance fees youll save more than with other higher rate cards. Increasing your credit limits is a good way to blunt the effect credit card debt can have on your credit scores.

Your bank can increase the credit limit of your existing card if you make a request. Make the chip-enabled Debit Mastercard your go-to card for purchases made from your Free Checking or Investment Checking account. This credit provides up to 3000 for the care of a child under 13 and up to 6000 for two or more.

Find out proven hacks. An increase to your credit limit is both a warm fuzzy feeling and a key indicator that you are responsible with your credit spending. Generally you need to apply for a secured credit card and pay a security deposit.

Make a direct request. The usual credit limit for a first credit card could be anywhere between 100 and 500 depending on which card you get. Click Credit Limit Increase on the left side of the page.

Run their customers through a credit limit increase algorithm every nine to 12 months to proactively give. SchoolsFirst FCUs maximum aggregate personal loan limit is 50000 per qualifying Member including all individual and joint personal accounts. Although this is contrary to the essence and rules instituted among creditors but you have the opportunity to immediately increase your credit limit on first credit card.

Get a response by mail within 14 days. One such example is an increase in your credit limit for one or more of your credit cards. Another way to request a credit limit increase on your First Premier Bank credit card is by calling First Premier at 1-800-987-5521 to reach customer service.

As low as 875 APR. SchoolsFirst FCU credit cards feature no cash advance balance transfer or over-limit fees and a 25-day grace period on new purchases when the entire balance is paid in full by the payment due date each month and your previous balance is zero or a credit balance. All loans subject to credit approval.

The issuer will take more factors into consideration when deciding your credit. Need a business credit limit increase. 2 of the statement balance or 25 whichever is greater.

For example you may frequently spend up to your credit cards limit. Use it in-person or online instead of cash or checks and keep track of every transaction the moment it happens. Once your credit card balance reaches that 2000 limit your card will be declined when you try to use it.

An increase to your available credit is a watershed moment in your credit history more so if youre rebuilding a bad credit score or you are brand new to having a credit card. Getting approved for a first credit can be difficult if you have little or no credit history. Your first credit limit may be as low as 100 if your first credit card is from a retail store but you might be approved for a slightly larger credit limit up to 500 if your first credit card is issued.

You can get a credit limit increase in several ways most often by. If you have a similar card forego requesting a credit limit increase and instead move to a better credit card as soon as you qualify. Or you may be looking to lower your credit utilization in order to boost your credit score and get a new rewards credit card.

There are many reasons to ask for a credit limit increase. Rates quoted are effective as of MMDDYYYY and are subject to change without notice. Parents who have to pay for child care can deduct a portion of these costs through the child and dependent care tax credit.

Its worth noting that this card caters to people with bad credit. For one the First Premier Bankcard charges 25 of the increase each time youre approved for a credit limit increase. Typically banks in the US.

SchoolsFirst FCUs credit card program features a range of variable interest rates based on a variety of factors including the applicants credit rating. The cash advance limit for the SchoolsFirst Federal Credit Union Inspire Mastercard is equal to the credit limit of the card. The good news is - you have an option to increase the credit card limit.

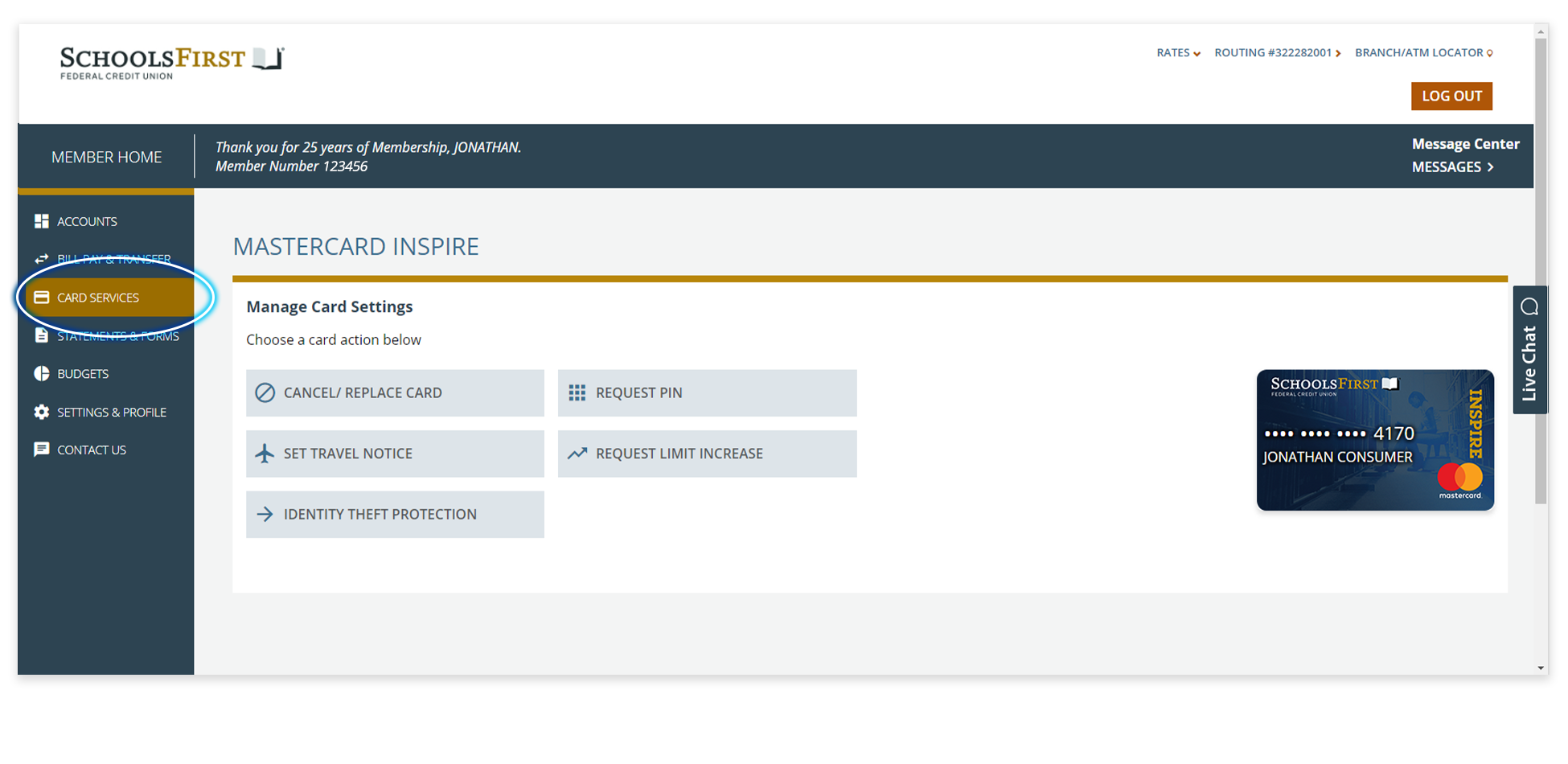

Click Request Increase and follow the prompts. If its your first credit card it will likely have a low credit limit but dont worry thats perfectly normal. It could be as low as 100 for store credit cards or up to 500 if your first credit card is issued by a bank or credit card company.

Schools first credit card limit increase Monday February 14 2022 Edit. Here are seven smart ways to raise the limit on your credit cards. Your credit limit is the total amount of debt you can carry on your credit card at one time.

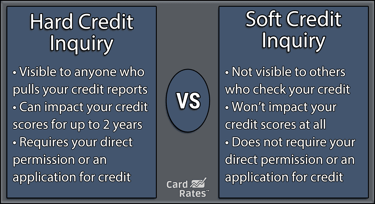

Naturally when applying for a credit card everyone will be interested in more than the minimum credit limitation in order to have more options. The advantage of getting a credit limit increase CLI without asking is that if you request a CLI the issuer likely will use a hard pull to review your credit scores. You can either do it before or after you apply for a credit card.

But yours can be more depending on your creditworthiness. The Academy Sports Outdoors Credit Cards starting credit limit can be as low as 100. A hard pull can knock a few points off your score.

An expanded credit limit lets you use your credit card to make larger purchases finance more necessities weather more emergenciesall without causing your credit utilization to climb too high. Credit limit increase. A credit limit also known as a credit access line or credit line is the maximum amount of dollars you can spend on your credit card before having to pay off some of the balance.

To bring you this benefit Mastercard has partnered with Generali a global leader in identity protection. Depending on the credit card and how financially stable you are credit limits can range from a few hundred dollars to tens of thousands of dollars. The cards credit line will be determined based on several factors like your credit score income and existing debts.

For example if you have a 2000 credit limit on your card that is the maximum amount your card provider will let you spend. Its convenient and secure with features that reward and protect you.

Which Credit Card Companies Do A Hard Pull For A Credit Limit Increase Doctor Of Credit

Faq Student Credit Cards Discover

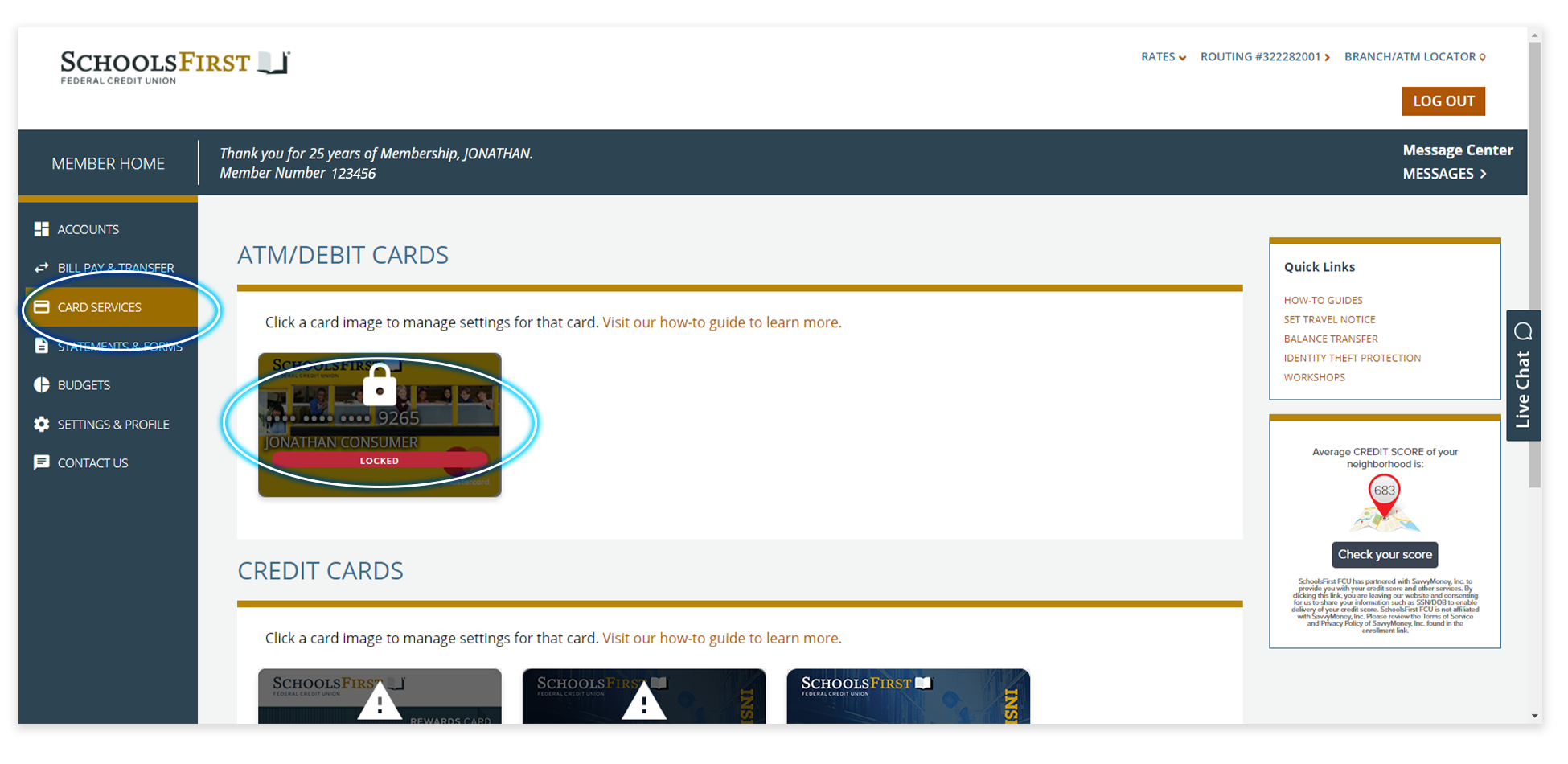

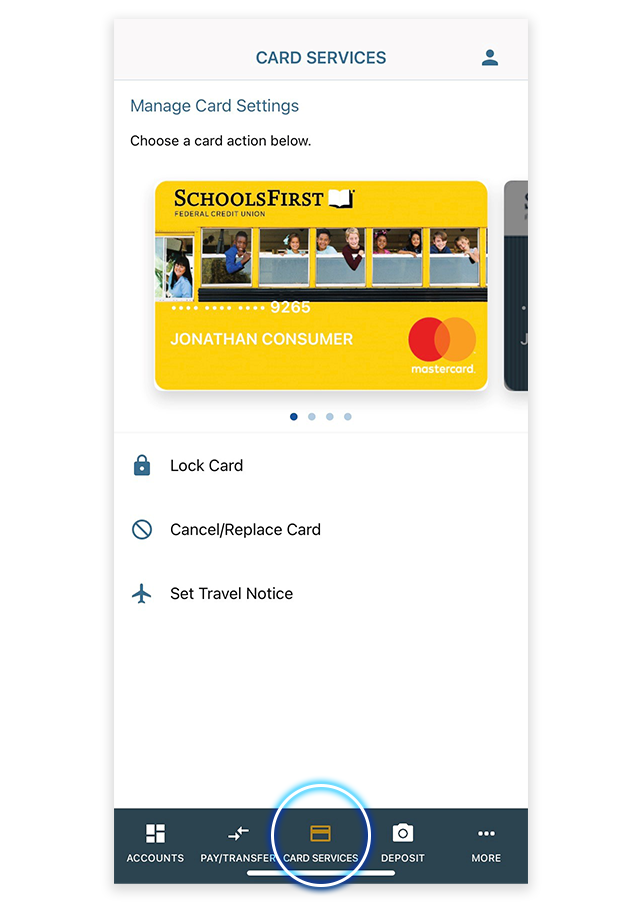

Credit Debit Cards Digital Banking How To Guides Schoolsfirst Fcu

3 Ways To Get A Credit Card Limit Increase Without Asking

How To Increase Your Mtn Mobile Money Limit Mobile Payment App Mobile Payments E Wallet

Which Credit Card Companies Do A Hard Pull For A Credit Limit Increase Doctor Of Credit

Credit Debit Cards Digital Banking How To Guides Schoolsfirst Fcu

3 Ways To Get A Credit Card Limit Increase Without Asking

Credit Debit Cards Digital Banking How To Guides Schoolsfirst Fcu

Unsecured Cards Vs Secured Cards 5 Things You Need To Know Oneunited Bank

Credit Debit Cards Digital Banking How To Guides Schoolsfirst Fcu

Sample Goodwill Letter Send To Original Creditors Credit Repair Letters Creditors Improve Credit

11 Tips To Survive Your First Year In Business Infographic Business Infographic Infographic Sales And Marketing

Credit Card Cash Withdrawal Charges Of Different Banks Car Loans Cash Credit Card Loan Account

Credit Debit Cards Digital Banking How To Guides Schoolsfirst Fcu

Getting A Credit Limit Increase With A Chase Card Credit Cards Us News

/askforcreditincrease-d8377edc62b945f697df536a640014d8.jpg)