extended child tax credit calculator

Partial Expanded Child Tax Credit. Ad Prevent Tax Liens From Being Imposed On You.

Tax Hacks 2017 Don T Miss These 16 Often Overlooked Tax Breaks Capital Gains Tax Tax Deductions Financial Apps

Here is some important information to understand about this years Child Tax Credit.

. Congress fails to renew the advance Child Tax Credit. Find more information on 2022 Refundable Child Tax Credits. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

The credit will be fully refundable. Tax credits calculator - GOVUK. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. For children under 6 the amount jumped to 3600. CPA Professional Review.

The 2020 Child And Dependent Care Tax Credit. Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or children born during 2021. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan.

Estimate your 2021 Child Tax Credit Monthly Payment. To reconcile advance payments on your 2021 return. The maximum child tax credit amount will decrease in 2022.

Enter the number of qualifying dependents between the ages 6 and 17 age as of Dec. Stock photo of calculator. But others are still pushing for.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return. The American Rescue Plan Act of 2021 has upped the child tax credit substantially -- as high as 3600 per child ages 5 and under for.

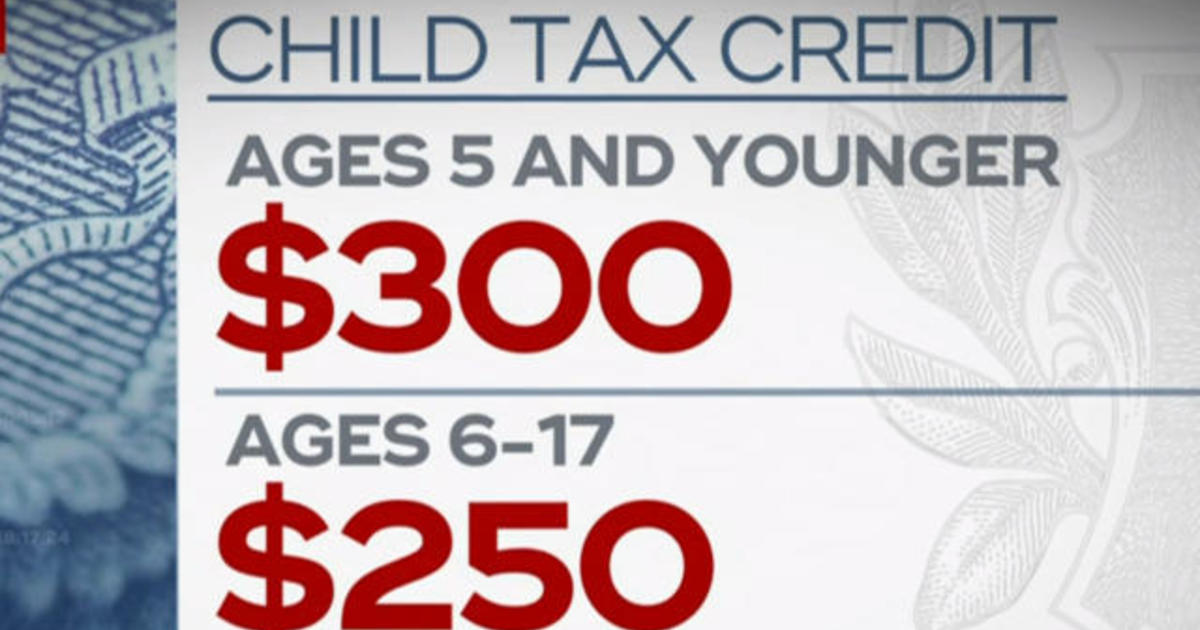

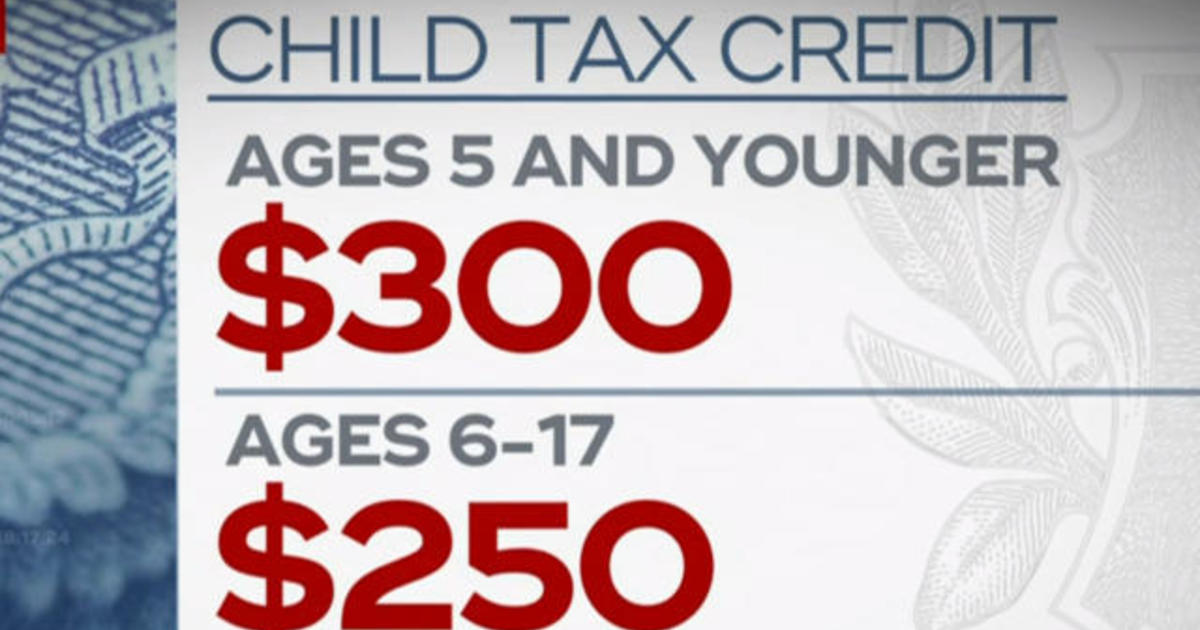

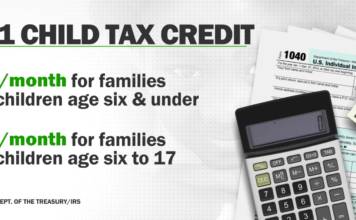

The Child Tax Credit provides money to support American families. 31 2021 for Tax Year 2021. The payments which could total as much as 300 for each child under age 6 and 250 for each one ages 6 to 17 will continue each month through December.

According to the IRS. Our child tax credit calculator will help you estimate your refundable child tax credit. The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6.

Free means free and IRS e-file is included. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. Max refund is guaranteed and 100 accurate. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. Enter your information on Schedule 8812 Form 1040. How to Claim the Dependent Child Care Tax Credit.

If your MAGI is over 75000 the credit is phased. Get your advance payments total and number of qualifying children in your online account. Unless it is extended.

Use This Simple Tax Calculator To Find Out if You Qualify For This Tax Savings. Maximize Your Tax Refund. Any excess advance child tax credit payments do need to be paid back IRS.

If you are paying for childcare during 2021 you will claim this as one credit on your 2021 tax return to be filed in 2022. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

September Child Tax Credit Payment How Much Should Your Family Get Cnet

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Income Tax Calculator Estimate Your Refund In Seconds For Free

Monthly Spending Budget Template

Your Tax Return Will Include Second Half Of Child Tax Credit Wfmj Com

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Try The Child Tax Credit Calculator For 2021 2022

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit Do You Have To Pay It Back In 2022 Not If You Re In These Cases Marca

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

September Child Tax Credit Payment How Much Should Your Family Get Cnet

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

2021 Child Tax Credit Calculator How Much Could You Receive Abc News